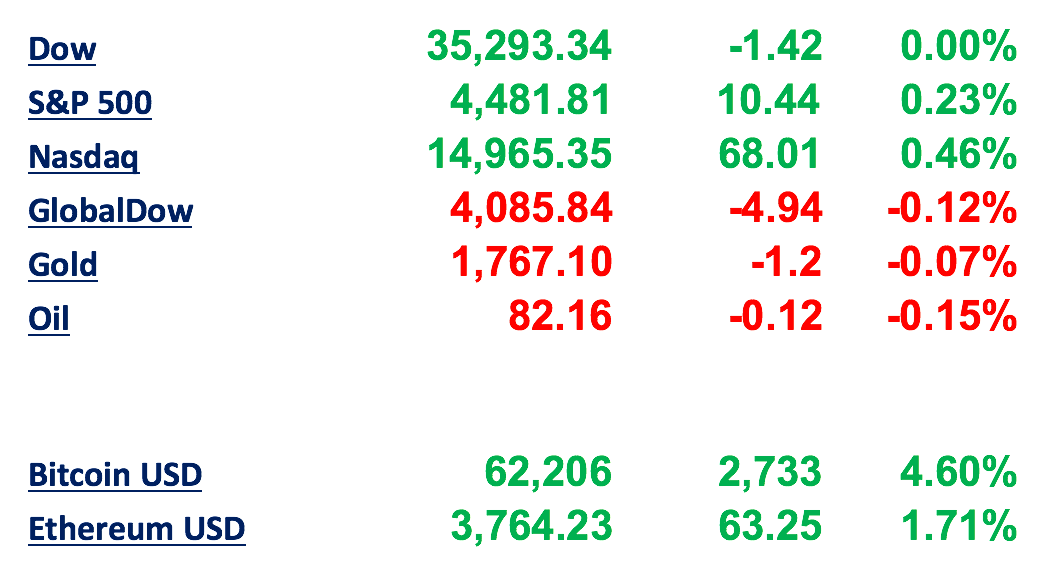

EXOTIC MARKET INTELLIGENCE.

Thursday - October 18th 2021

EXOTIC MARKETS

Good morning ladies and gents, we have an extremely interesting week coming up and some hilarious stories to touch on. Buckle up. Third-quarter earnings are set to ramp up this week with expectations of several formal Bitcoin ETF approvals as well. As of right now crypto bounced off a brief sell off Sunday to be in striking distance of all time highs once again.

Bulge Bracket Banks like JPMorgan Chase (JPM) to Goldman Sachs (GS) kicked off the Q3 earnings season with solid momentum. Asia stocks and U.S. futures dipped Monday as climbing energy prices increase worries about inflation, bond yields moving higher.

An exchange-traded fund (ETF) tied to the Bitcoin is set to begin trading on the New York Stock Exchange tomorrow, a milestone for the industry and good sign crypto is here to stay. We will continue to release updates on ETF devlopments

"Squid Game," Netflix Inc's biggest original series launch, is estimated to be worth close to $900 million for the streaming giant at this point

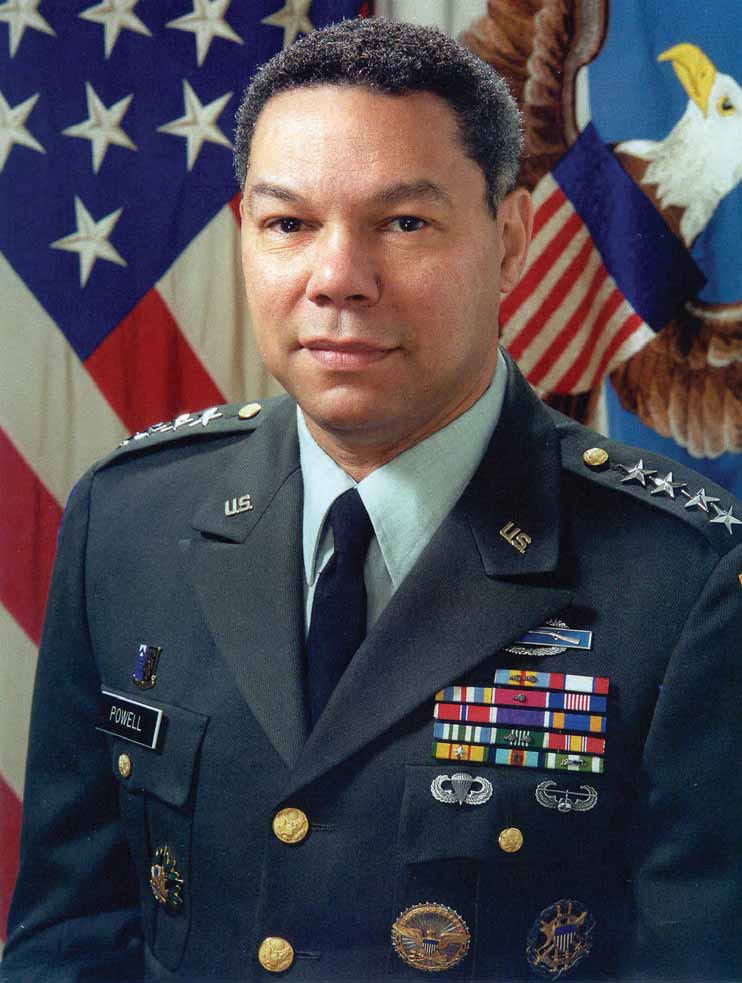

Colin Powell, the first Black US secretary of state whose strong leadership skills in several Republican administrations shaped American foreign policy has died from complications from Covid-19, his family has said on Facebook. RIP, good soldier.

As of August, New York City’ financial-industry jobs (not including real estate) were down about 5 percent, to 338,800, compared with pre-COVID August 2019

Grayscale Investments plans on filing an application to convert the world’s biggest bitcoin fund into a spot ETF early next week, according to a person with knowledge of the matter (CNBC).

Interactive Brokers Group introduces cryptocurrency trading for financial advisors in the US as of an hour ago….

Steve Sanders, the EVP of Marketing and Product Development at Interactive Brokers, said that cryptocurrency has become a common component of a well-diversified portfolio and that the company wishes to provide RIAs with all the tools they need to be successful (TheStreet.com).

Additional features available on the IBKR RIA platform include:

No ticket charges, no custodial fees, no minimums and no technology, software, platform or reporting fees.

No in-house advisory team or proprietary trading group to compete with advisors for clients.

Ability to trade stocks, options, futures, currencies, bonds and funds on over 135 markets from a single integrated master account, and trade cryptocurrencies from the same platform.

Free CRM, portfolio management and trading platform, plus PortfolioAnalyst®, which gives advisors the ability to consolidate and analyze a client’s entire portfolio, including assets held at other institutions.

Automated and flexible client billing.

Free compliance and website building services.

Debit Card and Bill Pay functions available for U.S. advisor clients.

More on the Interactive Brokers launch HERE.

Initial reports from Prospect indicate Jerome Powell may have dumped over $5M of securities before a major drop in the months during the pandemic, more on this as we hear

EXOTIC NEWS

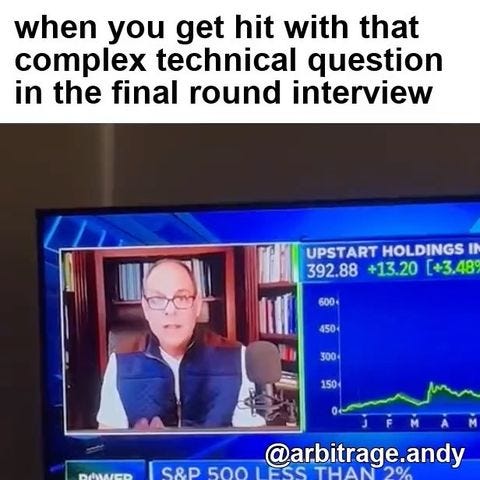

Mark Minervini, the trader who recently climbed to internet fame for claiming to encounter audio issues when asked what the company (Upstart) of the stock he was trading does. The original video is below. Since the increase in twitter retweets and posts of his original video, Minervini has gone on an insane tirade, flexing like a hardo with diesel alpha activities to flex on haters and trolls.

First he released a video of himself in his Lambo, with his wife or mistress filming? He burns out in the upscale neighborhood Need for Speed style and flips us off.

Then he posted some videos from the gun range of him shooting Troll targets. He seems super pissed at the trolls for someone with so much wealth. Should he be ignoring the haters?

Minervini says the fame and traffic is increasing his product sales. Insecure face saving or marketing genius, you decide. Slow draw though.

Let’s see how this plays out - what do you guys think of Minervini? Is he flexing on trolls or going too far? Let me know in the comments.

NEW CRYPTO MERCH DROPS - ARBITRAGE

BTC 15 Minute Chart as of 12:25pm ET

My unofficial guess for a price target we see this week with ETF momentum from BTC is $72 - $76K. For ETH, I would wager it sees $5,000 before the end of October. Let me know where you think the pair will be trading as we see more and more announcements this week on institutional involvement and ETF approvals.

I should remind my readers as a BTC investor I recommend owning your Bitcoin (buy-directly through an exchange and use a hardware wallet) and largely avoiding these institution led formalities, many of these vehicles will inherently become centralized and bureaucratic which are features Bitcoin aims to alleviate. You are watching the real time cope of boomers and traditional finance professionals as they face a behemoth paradigm shift. If you have any questions throw them in the comments.

While we have focused much of our coverage and analysis on BTC we will be diving into some of the most popular alts this week as well as stock plays for the fast approaching new year!

Re Minervini; That was BRUTAL to watch on TV last week!! Listen, I get it - why was he a buyer of $UPST ? "Because it's going higher!" THAT would have been a much better answer than his stammering about "bad connections!" Crypto; BTC, ETH, hell - even SHIB are all going higher. I enjoy your content (and my hat!) Keep up the good work ..

Another great letter. Interested on the stock plays as we approach the new year. Are you still crypto only for new buys until then? I'm similar apart from some direct debits (uk) into low cost funds for some broader sectors.