With an extremely volatile week for both crypto and equity markets, traders, hedge funds, and retail investors are looking for ways to orient themselves in the face of the Federal Reserve’s double edge sword. Do they commit to the recent hawkish rhetoric to raise rates and risk a more profound correction in markets that have been largely propped up with QE and buyback programs? Or do they continue to print money and buy stocks and bonds, sending this clown show even higher and enriching asset owners?

Remember to share this with fellow Arb Seekers, goal is to build a community large enough to continue putting out better and better content.

MODERN MARKET INSIGHTS

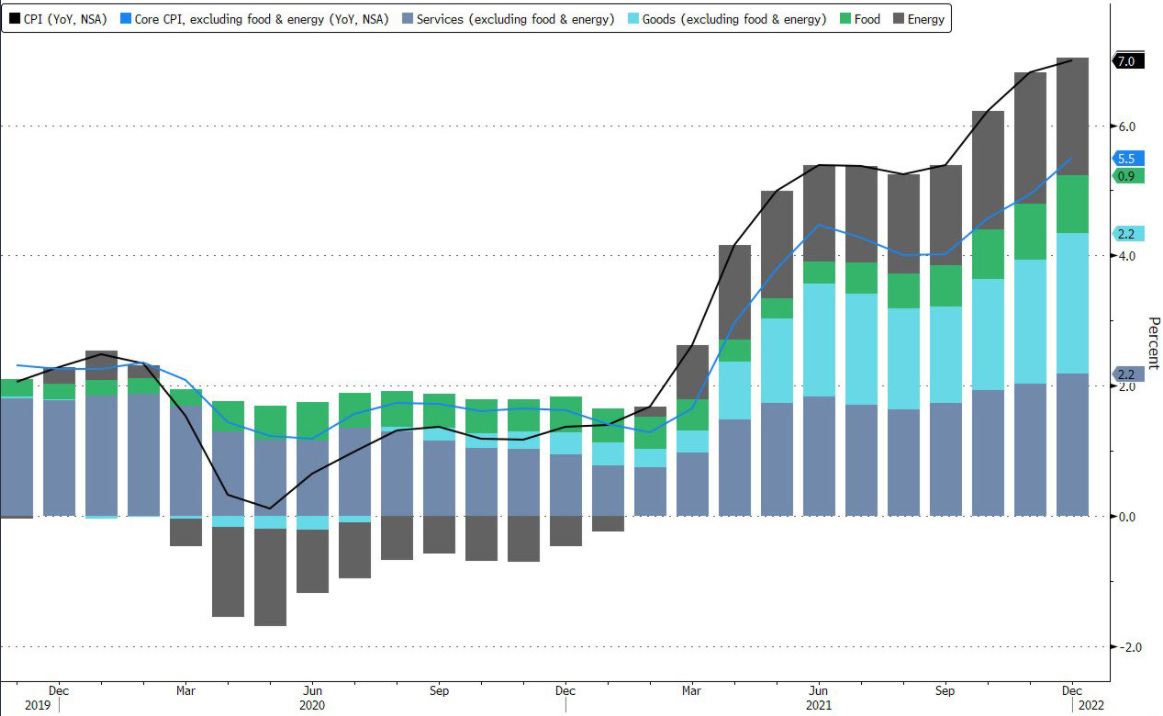

Markets will experience continued chop as uncertainty about inflation and the Fed’s actual response remain in balance.

Citadel Securities said on Tuesday that venture capital firm Sequoia Capital and crypto-focused investment company Paradigm had made a $1.15 billion minority investment, giving the market maker founded by billionaire size king Ken Griffin a valuation of close to $22 billion.

Cathie Wood expecting a crash in the Used Car Markets

The Federal Reserve is likely to hike interest rates more than expected in 2022 conditions said Goldman Sachs analysts this past weekend

ARKK and FANG stocks sold off aggressively last week as the Fed FOMC meeting took place. Selling continued into Monday morning

U.S. consumer prices (CPI Index)climbed to 7% over the past 12 months, the biggest annual increase since 1982, BTC reacts positively

Coinbase held $139 billion in crypto for institutions last quarter vs $17 billion in Q3 2020 (717% YoY increase) (Blockworks)

Chinese stocks, JD and BABA have seen some solid upside in recent days moving up roughly 3%. This comes on the heels of Charlie Mungers massive double down bet on BABA last week. I remain bullish on a Chinese bounce across the board through summer.

Goldman Sachs has just recently cut its 2022 forecast for China economic growth to 4.3%, down from 4.8% previously.

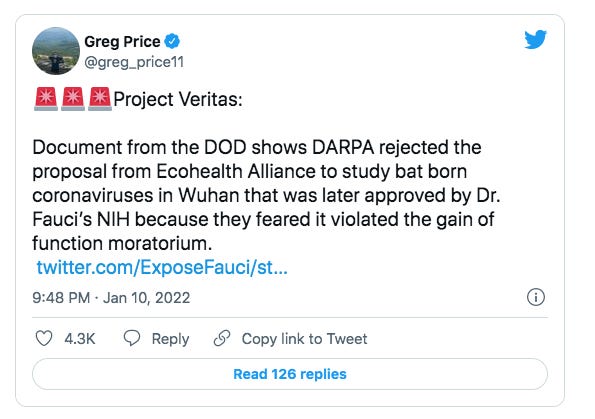

A proposal that was rejected by DARPA saying it is ‘too dangerous’, was later approved by the USA’s NIAID, which is headed by Dr Anthony Fauci. More Details HERE. Whether or not you believe Project Veritas is one thing, but I have read through the details of the release the past 48 hours, and it is certainly damning. More and more evidence has been released steadily since October 21.

On the topic of inflation - if you don’t own a JPOW Money Printer Mug you are behind the ball.

CRYPTO

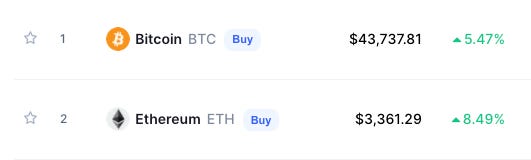

Just this morning prior to news of the CPI release, crypto slowly continued its creep from recent lows. With release of CPI figure of 7% BTC has pumped slightly sitting below $44,000 with ETH approaching $3,400.

I remain long in BTC and ETH as well as LINK, which has seen considerable appreciation with the announcement of Staking, CCIP, and Enterprise scaling in 2022. This is not financial advice, but barring unforeseen macro impacts that negatively impact crypto as a whole, my “lick my finger and throw it in the wind” estimate is that LINK will reach $80-$125 this year with staking going live and oracles/middleware capturing a large piece of the narrative within defi/crypto. Not financial advice.

You can view the market cap and metrics of top coins/tokens/projects HERE.

I believe we are at a critical point in the inflation/covid crisis narrative where Bitcoin and other quality projects/tokens will have to decouple meaningfully from the Nasdaq and equity markets. If I don;t see that in the coming months, I may change certain aspects of my thesis and will of course convey them here for all of you in advance of any re-allocations, selling, or positioning.

GLOBAL INTELLIGENCE

Over the last couple weeks violence has broken out in the Republic of Kazakhstan. Not since the 1990s, shortly before the countries independence, has violence and unrest of this severity broken out in the once former soviet bloc country.

While Kazakhstan is the home of our beloved Borat, it’s also proven to be historically significant to the Soviet Union and now Russian Federation. The nation plays specific geographical importance, acting as a conduit for rapidly expanding Asian Markets and Europe/Russia. Kazakhstan is a large Bitcoin mining nation, and the hash-rate, or measure of the Bitcoin networks computing potential/power, was impacted negatively by internet outages caused during the unrest recently in country.

Beyond modern internet coin size, Kazakhstan is one of the wealthiest countries, boasting massive oil and uranium reserves (about 50% of world supply). Recently thousands of people have taken to the streets in Kazakhstan to protest the doubling of the price of gas after the government lifted subsidies. Themes of wealth disparity also echo within the demographic of the countries poorest individuals and families. (Penn Today).

On Jan. 5, standing Kazakhstan President Kassym-Jomart Tokayev, a firm ally of Putin’s, requested support from the Collective Security Treaty Organization, of which Putin’s Russian Federation is the leading member. Russia has responded decisively by sending paratroopers, special operations troops and equipment as part of a nearly 3,000-strong force to Kazakhstan (theconversation).

Tokayev explained within his request for help that protesters are really “a band of terrorists”. Violence has broken out in the streets, with rioters gaining access to weapons and police equipment caches. On Jan. 7, Tokayev added fuel to the fire: “I have given the order to law enforcement and the army to shoot to kill without warning,” Tokayev said flagrantly.

Kazakhstan has a turbulent past marked by it’s relationship with the former world Super Power, the Soviet Union, and now the Russian Federation headed by Vladimir Putin. Riots, protests, and war are not strangers to the country:

One of the things that led to the notion of Kazakhstan as a country was a series of demonstrations in 1986, when Gorbachev replaced the chairman of the Kazakh Communist Party with a Russian from Russia. The people, particularly in Almaty, launched huge demonstrations that were very peaceful until the authorities stepped in; then they got violent, and perhaps 1,000 people died. This fueled the birth of parties that moved for an independent Kazakhstan. Later, in 2011 there were huge protests in western Kazakhstan for the same reason we’re seeing now: economic conditions. In 2016, there was a land-reform protest, largely against selling land to China. In 2019 there were huge protests that led to President Nursultan Nazarbayev stepping down. Protests are deeply ingrained in this country (Penn Today).

The unrest is markedly a key opportunity for Putin to take advantage of chaos and re-assert Russia’s former sphere of influence within Central Asia.

While Russia will surely position their move into Kazakhstan as a necessary peace keeping mission to their people at home, it’s obvious that the territorial ambitions of Putin do not stop in the Ukraine where he has demonstrated anti-west aggression recently. This is a multi pronged approach to perceived aggression by the US and NATO. Russia’s territorial aggression in Europe and Central Asia should not be taken lightly. President Biden announced today that economic sanctions are at the ready, if Putin chooses to invade the Ukraine.

Russia’s broader regional demands, according to Reuters, include a “halt to NATO enlargement, no deployment of its weapons systems in Ukraine and an end to "provocative” military exercises" in the region. U.S. officials said they pushed back against such demands during the Geneva meeting.

Photo above looks like Verdansk, but I digress. IYKYK. We will continue to monitor the situation as it develops in the Ukraine and Kazakhstan but this should at least give you an idea of what is at play presently.

OTHER ANNOUNCEMENTS

In a week or two we will provide a start to finish instructional post on how to deploy cash into crypto in the most straight forward and simple way possible. This will be a basic level video for people new to crypto and will be simple enough to share with parents and friends who want exposure to the asset class, more to come on that soon. Excited to announce one of our major partnerships as well.

We’ve been working behind the scenes to get together on of the most exciting initiatives we have constructed at Arbitrage Andy and Arb Letter, a podcast. While we expect to have a preliminary episode out in the coming weeks, there are some technical tweaks to make. Nevertheless excited to bring you guys alpha in the form of legendary guests who can share their experiences in business, markets, crypto, and other relevant realms of life.

We appreciate all feedback as we continue to build out Arb Letter. Let me know in the comments which topics you want touched on or flushed out in the coming week.

Andy

Great read, if anyone is more interested in the whole ex Soviet Union issue and why it's the way it is, read Revolutionary Russia by Orlando Figes and Red Notice by Bill B. Both are great reads with good insight into Russia throughout time

As a slight preview to the Crypto buying article what's your exchange recommendation taking into consideration 1) Ease of use, both trading and moving to and from wallets 2) fees 3) number of available investments?