Happy New Year folks - hope you’ve had some time to refocus, see family, and think about what you will be taking on this year. 2022 will surely be a massive year for disruptive technology, defi/crypto, elevated equity markets, the rise of decentralization, all while being packed full of unexpected government false flags and countless new variants (I kid, partially).

As I move into 2022 I am focused on mainly three things:

My side hustles (crypto, Arbitrage Andy/Arb Letter/Podcast)'

Family/friends

My health and fitness

Suggest everyone use this week to get your priorities in order, scope that new job you want, invest in that crypto you’ve been researching, whatever it is. Use this week to plan how to attack what you actually want to get done. Write it down, visualize and go do it.

We will also be hiring some new members of the Arbitrage Andy/Arb Letter team - I will post details in the coming weeks but we will be looking for a contributing writer as well as someone to help with media/ad partnerships. Look forward to building this community even bigger as financial markets, paradigms, and the world change quickly before our eyes in 2022. As usual feel free to provide feedback and content suggestions in the comment section below.

MARKETS INTELLIGENCE

Apple (AAPL) officially surpassed a market capitalization of $3 trillion yesterday and will be all investor normies talk about for weeks lmao.

For the fourth year, Bloomberg News synthesized the key market views from dozens of 2022 investment outlooks and presents more than 500 of them below. They can be sorted by institution, asset or theme.

A total of 1,082,549 new coronavirus cases were reported Monday, according to data compiled by Johns Hopkins University, as the highly infectious omicron variant continues to spread throughout the country and beyond (CNBC).

“There is no further negotiation going on at this time,” Manchin told reporters on Capitol Hill about the Democrat Bill Build Back Better. Yikes.

Eminem purchased a Bored Ape YC NFT this past weekend, dropping over $450K on one that looks similar to him with the weird conductor type hat he adopted in older years

ARKK added 441K shares of $PLTR on Monday but somehow I am still down 20% on $PLTR and 30% on ARKK so not sure how this helps.

Nearly one-third of hedge fund managers plan to add crypto to their portfolios in the near future, according to firms surveyed by EY for a recent report on the global alternative fund industry (Yahoo Finance).

A federal jury convicted Elizabeth Holmes, on four of 11 charges that she committed while running Theranos Inc. ILLEGAL SIZE QUEEN .

Bridgewater, the world’s biggest hedge fund, named two new chief executives Monday afternoon after David McCormick, the current chief, told employees he’s stepping down to consider a U.S. Senate run. Nir Bar Dea, the deputy chief executive of Bridgewater, and Mark Bertolini, a Bridgewater board member and former chief executive of Aetna, will now head up the hedge fund together (NY Times).

Hedge funds gained 8.7 per cent on average from January to November 2021, according to data provider HFR underperforming the S&P 500. Article HERE.

President Joe Biden said Tuesday afternoon: “You can still get COVID, but it’s highly unlikely that you’ll become seriously ill,’’…….. “If you’re vaccinated and boosted, you are highly protected. Be concerned about omicron, but don’t be alarmed. And if you’re unvaccinated, you have some reasons to be alarmed.”

MODERN MARKET INSIGHTS

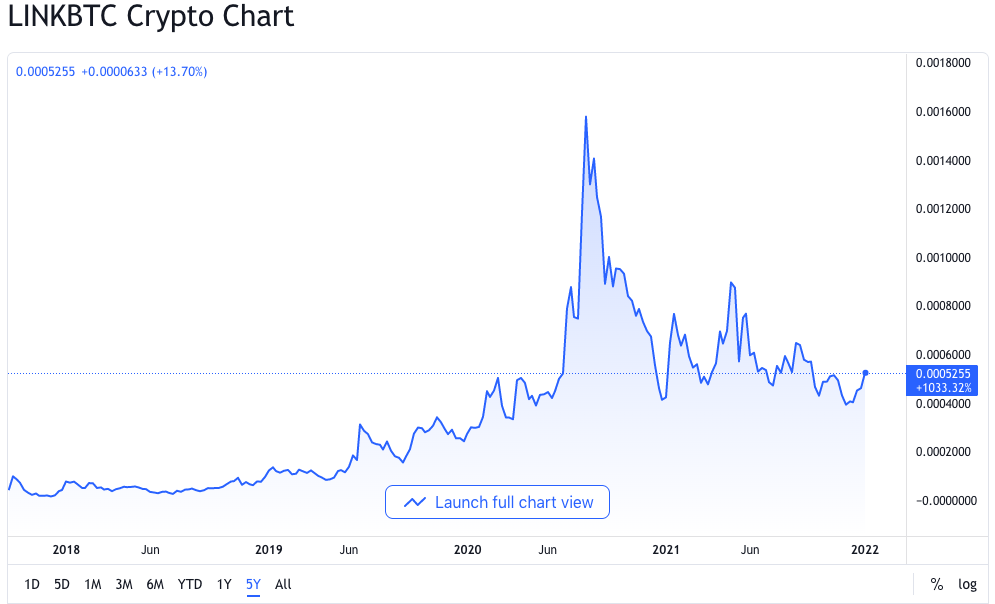

One of my favorite crypto projects, the middleware oracle solution Chainlink $LINK, kicked off 2022 with some extremely promising updates from the founder of Chainlink, Sergey Nazarov after a less than riveting 2021 that bled my position. Now remember, this is not financial advice, but in my opinion I am dropping some serious free alpha here for folks looking to capture sizeable upside in defi. Full transparency $LINK is now my biggest bet ever in financial markets, surpassing the amount I initially threw at $BTC or $ETH.

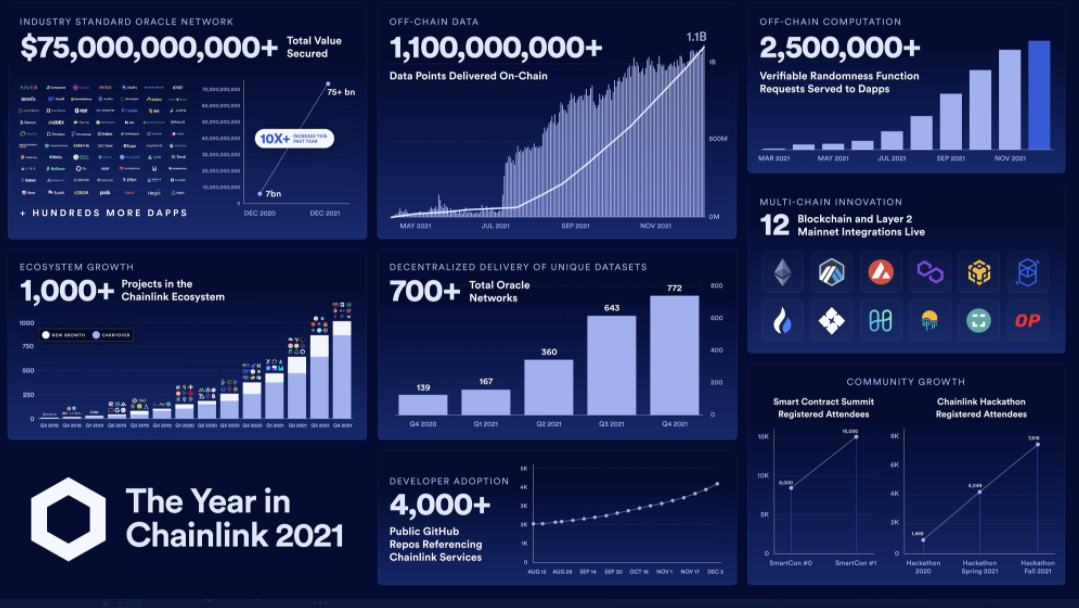

I have linked the update/video below but the 2022 kickoff included the highly anticipated announcement of staking (This could be life changing passive income for holders), the upcoming interoperability with CCIP, as well as the emerging use of Chainlink as an abstraction layer for Web 2.0 and large enterprises. Worth noting as well that Chainlink Nodes are becoming profitable and the Chainlink team has paused their regularly scheduled market bulk sell orders on the Chainlink token for several weeks now.

Chainlink price has reacted positively in the past 48 hours and a quick look at several different fundamental and technical charts offers a pretty tempting entry for anyone bullish on middleware and oracles in 2022. I’ve mentioned it before but I am very long $LINK, although still slightly down. It matters not, it’s a 3-5 year hold for me and their roster has become absolutely packed with ex Google Talent amid other former tech heavyweights. If you can grasp the the basic idea of what Chainlink is trying to accomplish and the market they are trying to address, it becomes clear to see how asymmetrical of a long play this project could be. If you don’t believe me check out the World Economic Forums posts on Chainlink. They tweet about it all the time lol.

Staking, is a relatively new concept to many participants within the crypto markets. My understanding as it stands, is that you can unofficially stake $LINK right now with what’s known as a pool. Why Stake? Staking is a way to make relatively high interest rates on lending out your crypto to a native network or protocol for a variety of functions. In essence, it is decentralization in action and allows those staking/putting up network collateral, to share in the fees generated by said protocol. Remember, Chainlink is the ultimately the link between on chain data and companies/enterprises utilizing smart contracts. Wide spread crypto fungibility between chains and real world companies interacting with the blockchain, will rely HEAVILY on Chainlink.

Staking your LinkPool Tokens (LPL) in the LinkPool Owners' Pool allows you to automatically receive your proportionate share of fees generated by LinkPool's services. You can stake through what’s known as a pool here with an alternative token called LPL (Link Pool Token):

Quick overview below of Chainlink’s major milestones over the course of 2021, but the scaling is absolutely absurd. The amount of value captured is going to be immense.

For now we wait for the official staking announcement which hopefully comes sometime in the spring/summer. This will surely be an explosive bullish catalyst for $LINK along with the crack team they are arranging, and expansive moves into enterprise blockchain usage, smart contract development, and CCIP.

More $LINK Resources for the curious homies:

Sergey Nazarov Discusses Smart Contracts, Staking

CCIP - Cross Chain Interoperability Protocol

World Economic Forum Presentation - Decentralized Data

These are highly technical concepts that I am trying to synthesize for the everyday reader and I myself am still a student on many blockchain and crypto related topics. If you have a point or comment to add feel free to do so below so that the community and readers can get the best picture of what we cover here. See you guys Friday.

Good stuff as always Andy. Take a look at Celsius for staking/interst payments. I've made about 80 bucks in 2 months with my eth bag and matic bag sitting there. Ill DM you in IG/Twitter if you're intersted. I myself, am researching how exactly celsius does it and if its staking or not. But so far, I've made more money on Celsius interest in 2 months than a AMEX high yield savings account that I've had for 4 years.

The Bloomberg synthesis is amazing - love this type of distillation. Told my son yesterday that Apple was the world's first $3T company. His reply - what about Tesla?