Well we all knew it was coming. Between the NFTs of Pepe the frog genitalia, to $GME and $AMC reaching record highs, and then all the way to the Federal Reserve loosey goosey we all get rich printing money policy that inflated the dollar drastically towards the end of 2021. Despite a new hawkish stance and sabre rattling of sorts about rate hikes, not much has actually been done yet in terms of QE raper or hikes. That is why this violent downside is concerning.

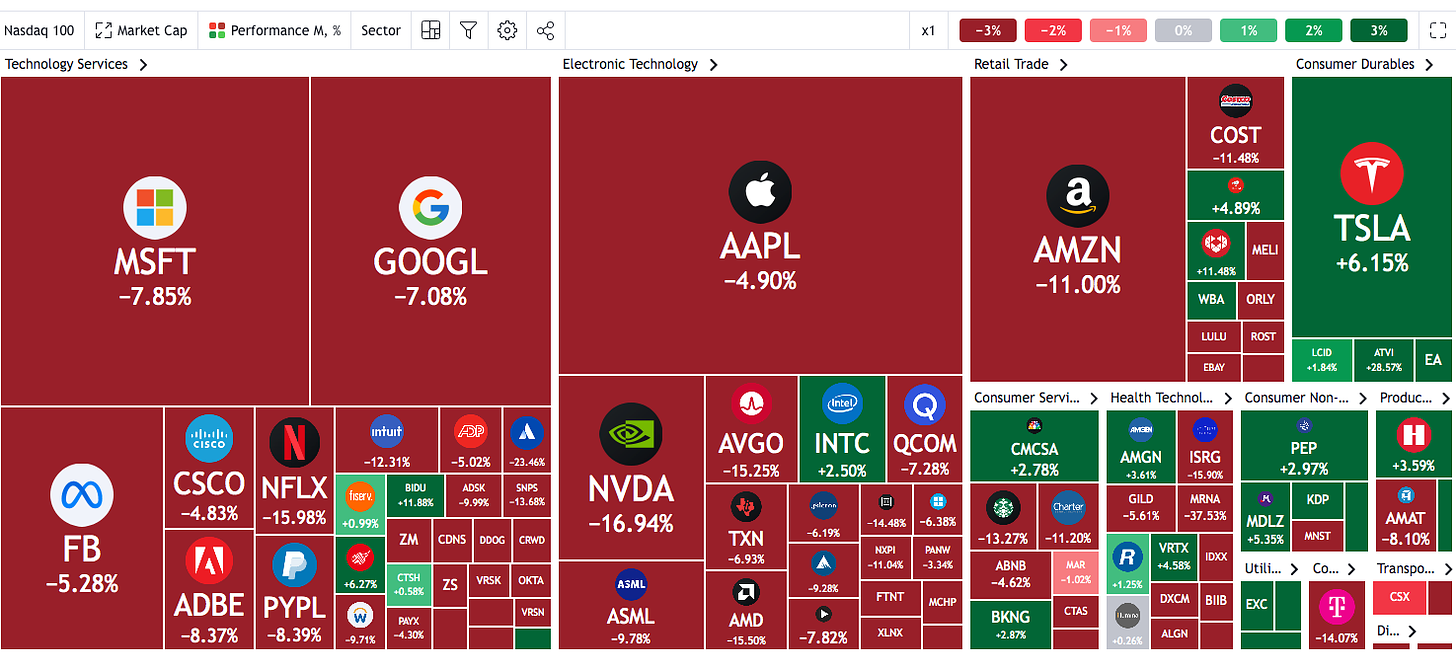

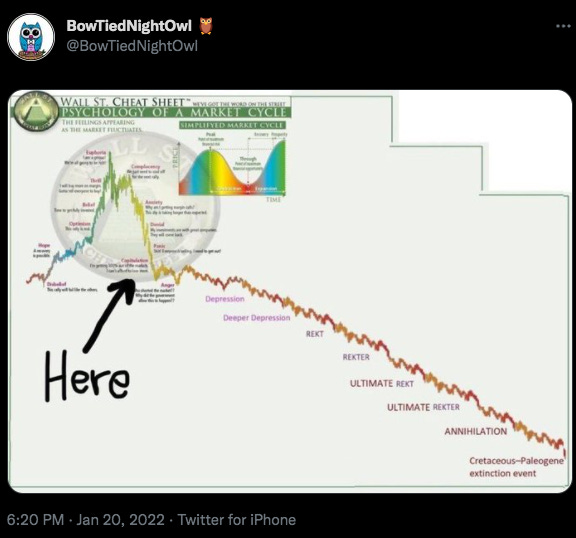

It appears the fuse has been lit on a broader market correction, fueled by macro volatility, rate hike expectations, and higher uncertainty in the short term for a local bottom. Tech is dumping hard. War with Russia is not out of the realm of possibility (Putin didn’t amass his tanks and armor divisions for no reason). Shit is expensive as fuck due to inflation and crypto markets seem to have increased their correlation to tech and equity markets, dumping in tandem hard (Hate to see that). There is not a bid to be found it would appear.

Here is my personal strategy for weathering this chop. Frankly, until the stock market settles down, crypto will experience high volatility. If Putin invades Ukraine tomorrow, we probably limit down overnight and shit proceeds to dump another 20% or more across the board. Point being, right now is anybodies guess as far as what happens next but you can’t fail to recognize several unique macro factors that are working against most long theses in the short to medium term. We are hard pressed for good news. Not financial advice, do your own research.

Once I feel a Tech bottom is in, DAC into $FB, $NVDA, $MSFT, and $AMZN

Intra day and Weekly Put Option trades on $QQQ and $VOO. Learn to safely and responsibly trade options, they are a grade hedge if employed properly

Adding to other high quality long term plays, i.e. $PLTR

Monitoring crypto portfolio, up enough still to not care, could change

$BTC at 35K and $ETH at 2.5K are areas I would take larger risk off

Accumulate a bigger and bigger cash position

Start a side hustle. Seriously, you want more cash available to fuel buying opportunities

Remember Consumer Goods, Real Estate, and Energy traditionally perform well in this environment

Can’t ignore the defense stock opportunity with global tension where it is - I like Raytheon and the PPA ETF.

Number one rule is to preserve capital and survive

This could be some beginning of the year chop and maybe we are able to recover but for now things do not look great, and given the macro environment and aggressive selling, I wouldn’t be surprised to see a broader continuation downward. Dollar Cost Average into good long term plays at a moment in time that you are comfortable with entering. Some great deals now and there may continue to be. I know a lot of people are down bad but remember this is part of the game, you have to weather the storm to get paid with a long term view.

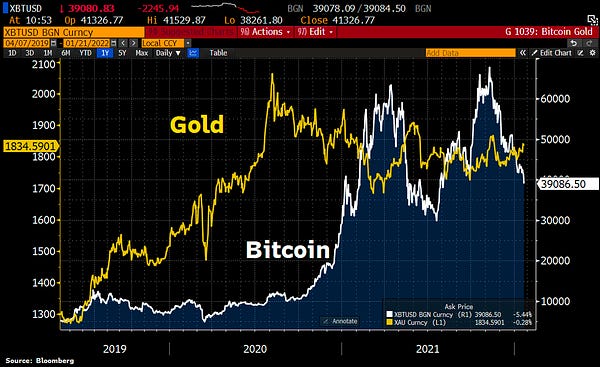

To be very clear I am still very long term bullish on crypto - but you all will note, and I have previously mentioned this, my large thesis component on the medium term price action was to see how Bitcoin reacts in the face of macro pressure and a declining dollar due to inflation. Long term that thesis hasn’t changed, but in the short term it may change. What we are seeing now, a more substantial continued correction, is natural in these markets, they are wildly volatile by nature and there is usually a 50% drawdown in each “bull” cycle for crypto. Could we rally back to $50,000 in 2 days? Yes. Could we also dump to $25,000 or lower and hang out for a year? Yes. If you have conviction focus on getting the best possible entries over time on particularly red days. Also, not to get schizo on you guys, but I am also weary of price action considering the verified presence of large institutional buyers and whales who are not selling but accumulating.

MODERN MARKET INSIGHTS

U.S. stock futures dropped even further Friday, with the Nasdaq again tracking for the biggest decline in pre market, the S&P 500 is poised for its worst week in 15 months.

Bitcoin fell below $40,000 last night and Ethereum fell below $3,000 momentarily, my favorite alt Chainlink is getting absolutely abused. I expect this to continue as long as stocks correct

Netflix shares plummeted nearly 20% in after-hours trading following earnings Thursday, the streaming giant fell short on net new subscribers, subscriber growth slows

It’s a small difference, but investors have been worried about Netflix — already one of the biggest streaming companies out there — being able to find new ways to keep growing. And by Netflix’s own estimates, subscriber growth is going to be low next quarter as well. The company estimated that it would add 2.5 million subscribers in the first quarter of 2022, down from 4 million during the same period last year (The Verge).

Peloton is halting production of its connected fitness products as consumer demand continues to wane and the company looks to control costs and shift sentiment. Stock down massively today.

Top diplomats from Russia and the United States warned Friday morning that no breakthrough is in sight on current negotiations. I am hearing from buddies in Special Forces and from internet sources that the situation is looking grim for the Ukraine. Russian invasion is seeming imminent.

JPMorgan CEO Jamie Dimon has received a $3 Million Raise to $34.5 Million total comp for 2021

Gold is starting to awaken a bit during these turbulent times after remaining dormant in the face of inflation narratives last year

Stock options totaling roughly $1.28 trillion are set to expire today potentially driving sharp market movements

SENTIMENT CHECK

"I think there is a rotation going on towards those areas of the market that have been neglected for a long time — not just months, but years. Areas like financials and energy. Even health care, which is an area that had done a bit better during the pandemic, but really isn't seeing any kind of multiples like it did in the past," Jeffrey Kleintop, Charles Schwab chief global investment strategist, told Yahoo Finance Live on Thursday.

“While a handful of rate hikes over the next year or two would represent a shift in Fed policy, we wouldn’t consider policy restrictive and we don’t expect the initial rate increase to derail the economic recovery,” said Scott Wren, senior global market strategist at Wells Fargo Investment Institute. (CNBC).

FIRST PODCAST

We are happy to announce we have recorded our first podcast interview with the New York Stocks Exchange’s most iconic broker, Peter Tuchman. Peter has worked on the NYSE trading floor for close to 35 years, weathering massive sell offs, instances of high inflation, and volatility. He’s witnessed the evolution of Wall Street at the hands of high frequency trading and technology and shares his awesome life story with us on the first episode. I am running through final edits this weekend and plan to release on Monday or Tuesday either under ARB Letter or our newly launched podcast series. You can read more about Peter HERE/

Peter talks working in Africa, running a Record Store, and working on the exchange floor for 35 years in his ascension to the coveted position of floor broker. He also offers valuable insight into retail trading and current market volatility.

Down the line we plan to expand our interview series to bring ARB Letter followers the best alpha and perspective we can from industry veterans who have hands on experience in financial markets, business, and life.

Everyone stay safe trading out there and remember to try and not trade when you are emotional, unless you absolutely need the money

If you are upset or down about paper losses or unclaimed paper profits you had at the very top, remember, hindsight trading is always 100%. In retrospect it was inevitable that we dump from those absolutely ludicrous valuations and inflated price levels that we hung out at all of last year. Now we see which assets are up to the challenge of weathering the worst inflation we have had in years, potential global conflict, and Federal Reserve action.

Andy

Tech still outperforming biotech, it seems: https://twitter.com/BowTiedBiotech/status/1484488649987305472