Happy Friday lords.

I’ll be honest — this week has had it’s ups and downs. On one side of the coin my wife and I welcomed our first child and son — which has been an insane whirlwind of emotions and sleepless nights. It’s been truly remarkable to experience. Highly recommend when you are ready — if we ever truly are.

On the downside, markets continue to hemorrhage with bleak macro headwinds, an expected 75bps rate hike in November, and a worsening situation in Ukraine.

Most of my holdings in financial markets, as I have expressed here before, are longer term, but that doesn’t mean that the conditions haven’t started to wear on me. I’m tired of down only, tired of the red, and almost numb at this point. I’ve noted anger and frustration on financial social media and different platforms which makes me scratch my head and wonder, are we anywhere near the bottom?

Maybe, maybe not and if we aren’t how bad is this eventual blow up going to end up being?

This week we have some wild market and news updates, some more drama on Twitter, and a quick recap of the escalating crisis in Ukraine.

We also added a new section to this week’s letter including the “W” (Win) of the week and the “L” (Loss) of the week.

Lastly we’ve touched on upcoming posts for next week.

MARKETS

The bear market tore on this week with major cryptos moving lower but some slight modest relief to equities, although that looks to be over with today as well. Bond yields soared.

Crypto has been frustrating. Bitcoin is hovering around $18,700 at the time of this post (8:21 am ET) and Ethereum is flirting with $1,200. It gets worse with select alt coins moving much lower, including our beloved Chainlink despite the announcement of staking and CCIP partnerships this year.

A good reminder that the quality of a project, even if it looks phenomal on paper, isn't exempt from the macro forces that are dragging down most asset classes. This weekend we will hold our breath and hope that crypto doesn't make the next leg down. if it does we will accumulate where we can and batten down the hatches to ride out this bear market.

US Equities look poised to lose modest gains from this week with futures slightly down.

The 10 year yield hit 4.2 %

Johnson & Johnson has cautioned about potential layoffs ahead

Credit Suisse is preparing to sell parts of its Swiss domestic bank and asset management businesses to help raise capital

Shares of Snap fell almost 25% in after hours trading following the earnings report.

In a wild twist to the twitter buyout saga, the Washington Post announced last night that Elon Musk said to prospective investors that he intends to cut nearly 75% of the workforce at twitter comprised of over 7,500 people. Elon also said that a recession could last until spring 2024.

US housing sales are continuing to drop for the eighth month in a row

Citadel has plans to double it’s European Staff

Institutional investors pulled out roughly $26 billion from hedge funds in the third quarter of 2022 (HFR)

In a predictable and potentially 4D chess development, the Biden administration announced that they may review some of Elon Musk’s ventures, including his buyout of twitter, for national security reasons. This could be one of the only ways the deal either gets thoroughly vetted or falls through completely. Did Elon know that was coming?

For better or for worse I will likely start trading call options again for major indices I believe are oversold (SPY/Nasdaq) to see if I can capture a stronger bear market rally or eventual pivot early to mid next year.

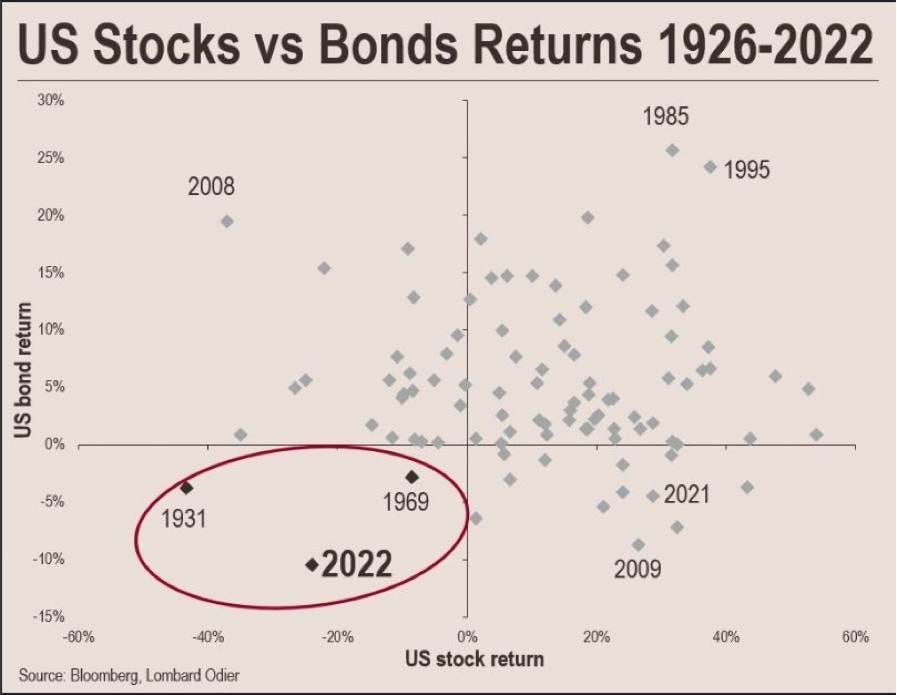

At the moment there is quite literally nowhere to hide in markets.

US bond returns in 2022 are in the same group as 1933’s executive order ‘6102’ and 1971’s Nixon Shock years when the drawdown in stocks and bonds forced the US government to default on its gold peg in the following 24 months (Finbold).

All eyes will be on the November rate hike/fed meeting so don;t expect any market calmness leading up to that event.

Equity names I am looking at accumulating in the short to medium term if we see one more sizeable move down:

SWBI - Smith and Wesson Brands - Trading around $10 - near historical range lows

AMZN - (Amazon) - After DCAing into a sizeable position over the past several years I am still somehow down roughly 15% on this position, will add more soon

NVDA - (Nvidia) - Nvidia is a name that I feel is being FUDed (Fear, uncertainty, doubt) hard in recent weeks. While the regulatory updates imposed by the Biden Admin (U.S. Commerce Department rule restricting semiconductor-related exports to China) and tension in China/Taiwan region. are concerning, I can’t help but buy more at the current level around $121.

TSM - Taiwan Semiconductor - Similar to NVDA we feel this name is underrated at the moment especially with regards to potential upside in Cloud and demand that should increase in the coming years. It trades around $63.58 currently.

The jury is still out on META (Facebook) - Seems Zuck has lost a lot of his steam and his Metaverse ventures has puttered out pathetically coinciding with the end of the crypto/web3 bull market.

A sizeable amount of options are set to expire today — meaning we should see one of the most volatile days of market action in awhile

Stay safe trading, preserve your capital, and keep your head on a swivel.

W of the week?

In an insane Alex Jones-esque rant crypto educator, commentator, and investor Ben Armstrong also known as Bitboy Crypto, called out Coinbase and FTX CEOs Brian Armstrong and Sam Bankman Fried saying they are trying to "permanently ruin" crypto.

In the rant he spoke to the fact that large institutional leaders in crypto are the devil and that they do not have the interest of common retail investors in mind. He does have a point in this regard as more and more institutions and”suits” start to get into the space. With the collapses of major ponzis and the blow ups of 3AC and Celsius, the landscape of crypto is sharkier than ever, with VCs, lawyers, and other predatory groups sifting through the wreckage attempting to profit and monopolize what they can.

Many expressed support on twitter and others stated that Bitboy had “won” them over with this speech. Let me know what yall think of his explosive speech in the comments.

You can watch the video below:

Runner up - The head of lettuce that outlasted Lizz Truss

L of the week

In a cringeworthy video Chris Baugh who is a top aide of NYC mayor Eric Adams on his “Advance Team” admitted to a sultry looking women who works for Project Veritas, that Adam’s is corrupt and ran his mouth off about firefighters, police officers, and government workers who lost their jobs because of the vaccine mandate.

You can watch the original here. He literally said that they were toying with private/public sector mandates and laughed saying “who gives a shit” Covid is over — “they had a choice, they could’ve gotten an effective shot and kept their jobs”

Effective? Literally all evidence that has come out in the last 8 months would vehemently point to the opposite but okay pal.

You can watch him lose his shit while sitting smugly in NYC when confronted by James Lalino a journalist for Project Veritas.

Say what you will about entrapment/Project Veritas’ methods but some of these people are absolute low lives.

These dudes need to understand that if a hot chick is eager to date them she’s probably a honeypot. You’re not that guy pal.

Like twitter user Jaedog105 stated:

"Is she really into me or is it Project Veritas?" "Eh, she's definitely into me."

In any case I’d be surprised if this clown has a job come Monday morning.

Runner up - Lizz Truss

GLOBAL NEWS

Iran has begun to make moves to assist Russia in it’s attacks on Ukraine — most recently providing a range of drones as well as surface to surface missiles to replenish the depleted inventories of thenRussian hordes.

National Security Council spokesman John Kirby told reporters Thursday that Iran has sent a some personnel to Crimea to help the Russians on the ground with adjustments and operations which marks an interesting escalation.

The White House said Thursday that the U.S. has some evidence that Iranian troops are "directly engaged on the ground" in Crimea and are actively supporting Russian drone attacks on Ukraine's infrastructure, power centers, and civilian populations.

In a concerning updates, Russia, Iran, and other nation’s including China have been urging state personel, diplomatic aids, and others to leave Ukraine this week as new offensives brew and the situation becomes more tense.

Personally, we think this is a canary in the coal mine for what could end up being a massive escalation of the conflict or, as we have mentioned multiple times, Russia and her allies know that something big is likely to take place that could impact large areas in Ukraine.

A new aid package could be within the range of roughly $50 billion for Ukraine from congress according to various reports

UK Prime Minister Liz Truss resigned today less than 44 days into her tenure — likely to be succeeded by Boris Johnson who has received overwhelming support from conservatives. Her time makes her the shortest-serving leader in British history

Dmitry Medvedev made a sly tweet about Liz Truss on Twitter yesterday referencing the internet bet in which a head of lettuce was put on webcam and said to last longer than Liz Truss’ tenure in her role — the lettuce won the bet. Hilarious stuff. Elon Musk commented “Actually a nice troll” before taking a stab at Medvedev asking how operations in Ukraine were going.

Mayor Eric Adams of NYC had a dismissive tone with CNN’s Chris Wallace about the recent chaos in the NYC subways — where violent crime this year through August was up 39% compared to 2019. This comes on the heel’s of the ninth homicide in the Subway system that took place in Queens.

66% of American workers feel worse off financially than they were a year ago due to inflation, (CNBC) via Unusual Whales

A CDC panel unanimously voted this week to add the COVID-19 mRNA shot to the recommended childhood vaccine schedule in the United States.

We’ve been pretty silent on the vaccine/pandemic front, mainly because the War in Ukraine took everyone’s eyes off of the obvious lies and deceit surrounding the Covid 19 pandemic. The reality now is that:

The shots/boosters aren’t anywhere near effective as was advertised throughout the pandemic

There are growing concerns of long term health effects, myocarditis, and heart health

The CDC, US Government and Pfizer failed to do any real tests about transmission impacts and conveniently omitted this fact

Let’s just hone in on one point here - transmission. Was it necessary to divide two groups of people for two years, fire them from jobs, tell them a dark winter of death awaited them, and segregate society when the vaccines do almost nothing to prevent transmission?

There’s literally no reason vaxxed and unvaxxed can’t be in the same spaces — countless cases of vaxxed and boosted people getting Covid multiple times.

It’s absolute clown hour.

We could rant on for hours about this an maybe we will do a deep dive but it’s now more obvious than ever that the pandemic served as an opportunity to market an experimental drug, profit tremendously, and mislead the entire nation.

Now you’re shilling this crap to kids? GTFO. Absolutely absurd.

I’m not making any definitive claims but it smells extremely bad to me and what only reinforces my feelings is that these leaks of evidence and facts to the contrary of what we’ve been told this entire time and IMMEDIATELY fact checked and denounced on the internet except for places where breaking updates can be seen and shared like Twitter, Discord, Youtube, and other platforms.

The censorship alone is reason for suspicion and skepticism.

And remember — Pfizer & Moderna currently have no liability whatsoever for any effects of this shot given the emergency authorization they pushed s hard to get.

Doesn’t sit right with me.

Upcoming Posts

We’re editing and finalizing our interview with BowTiedOx — a digital friend, former US Army Ranger, bodybuilder, and successful business owner.

The interview will be in written form and we’ll cover business, life, becoming more fit, and a whole host of other topics. We expect to drop that next week for paid subs along with a deep dive Monday on the current trends we are seeing globally towards the consumption of insects and bugs.

At one point people legitimately thought BowTiedBull (who originated the concept of eating bugs) and I were kidding when we started mentioning this phenomenon at the start of the 2020/2021 crypto bull market — but macroeconomic conditions, globalist agendas, and strained supply chains have pushed this narrative to the forefront of many countries. It’s actually hilarious (and concerning).

If you missed it yesterday morning we dropped a guide to options trading with educational platform OptionsSwing. In it we covered all the basics you need to begin trading options easily including:

Background on options

Advantages/risks of using options

How options are valued/priced

Call Options

Put Options

Basic strategies/tips

Some ideas to get started and a list of the best option’s platforms/brokers

The full guide is available to all of our paid subs HERE.

And last but not least a quick morale boost for the troops before the weekend. These bear markets and constant negative news headlines can be wearing on all of us and I think it’s important to have some levity, nostalgia, and perspective to help weather the storm.

Enjoy your weekend and see you guys Monday.

Andy

Definitely up for a vaccine deep-dive!

Gov't is in full damage control with the vax here. Currently they are shifting blame to Pharma and getting you to think past the sale on vaccine mandates. The policies were terrible. But you have to blame the government for that. They're trying to play off mandates with 'misled on transmission data', which implies the mandates would be good if it had helped reduce transmission. Don't let the policy makers off the hook or fall for the 'outraged vs Pharma' bait, especially if you already have good reason to hate Pharma.

To illustrate how this latest bit is a psyop aimed at deflecting people rightfully mad at mandates from the gov't, note how the following timeline gets confused.

1) initial trial measures severity of disease. No data on transmission, warnings at the time were to not assume transmission was blocked. This is what Pfizer stated, and is correct.

2) Transmission was measured *after* the vaccine was deployed, but not by Pfizer. Everyone monitoring cases saw the drop. There was no 'misleading' here.

3) The virus changes over time. Vax efficacy for delta was ~60-80% IIRC. Omicron is a full escape mutant. Until the most recent booster released in August, all boosters aimed at the original Wuhan strain.

4) Policy lags with time. Gov't used the transmission data from Wuhan strain to justify mandates, which came after that strain was no longer dominant. Problem is omicron and/or delta were dominant strains then, and both had already escaped to varying degrees. Nevermind natural immunity. All that anger you feel over this should be focused on one target: the policy makers. Hold them accountable via your legal options (ie get candidates on record for their position, vote in Nov and then hold the elected officials accountable). Do not let them wiggle out of this by blaming another entity you dislike.

5) Boosters address issue of lagging titers, not escape mutants. To keep up with escape mutants, I estimate we would need 2x boosters per year to keep up.

6) Without transmission data on the *current strain*, no evidence having your child vaxxed will protect other kids. Also needs to be compared vs natural immunity. CDC decision is terrible, but also not Pharma. Laser eye focus on the policy makers.